Business Insurance in and around Lima

Calling all small business owners of Lima!

No funny business here

- Spencerville, Ohio

- Detroit, MI

- Ann Arbor, MI

- Columbus, Ohio

- Wapakoneta, Ohio

- Bluffton, Ohio

- Ada, Ohio

- Marysville, Ohio

- Putnam County, Ohio

Coverage With State Farm Can Help Your Small Business.

You may be feeling overwhelmed with running your small business and that you have to handle it all alone. State Farm agent Shane Crites, a fellow business owner, understands the responsibility on your shoulders and is here to help you build a policy that's right for your needs.

Calling all small business owners of Lima!

No funny business here

Customizable Coverage For Your Business

If you're looking for a business policy that can help cover extra expense, equipment breakdown, and more, State Farm may be able to help, just like they've done for other small businesses for almost 100 years.

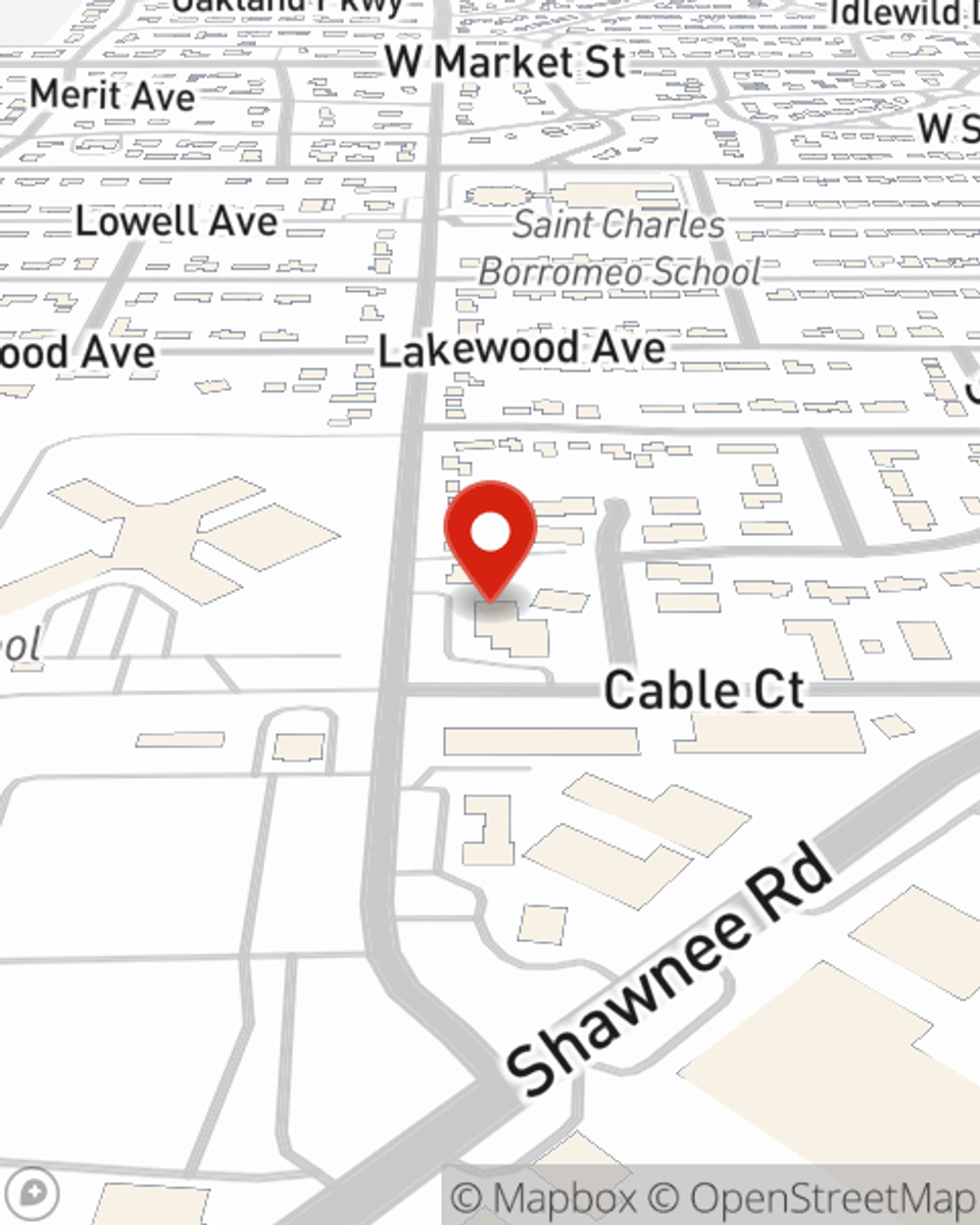

Reach out to State Farm agent Shane Crites today to learn more about how a State Farm small business policy can ease your business worries here in Lima, OH.

Simple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Shane Crites

State Farm® Insurance AgentSimple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.